Insights into the Global Consumer Electronics Market and Emerging Trends

Overview

This case study explores the dynamic global consumer electronics market, highlighting key trends and regional insights. It examines the market’s growth driven by technological advancements and rising consumer demand, with a focus on manufacturing in Europe and retail in the US. The study delves into consumer behavior, emerging trends like sustainability and health-focused electronics, and provides a comprehensive revenue and volume analysis.

Table of Contents

€24.0bn

3862

5.7%

Revenue (EU)

Businesses

Profit Margin

$168.5bn

54093

4.2%

Revenue (US)

Businesses

Profit Margin

Introduction

In today’s fast-paced world, the consumer electronics market is ever-evolving, with new technologies and trends emerging regularly. Our client, a leading player in this industry, sought to understand the global market landscape and identify the key trends shaping the future of consumer electronics.

The primary objective of this study was to provide our client with comprehensive insights into the current state of the consumer electronics market, including revenue trends, key players, consumer behavior, and emerging trends. By doing so, we aimed to equip them with the knowledge needed to make informed strategic decisions and stay ahead of the competition.

To achieve this, we conducted an in-depth analysis of the global consumer electronics market, leveraging data from some reputable sources. Our research spanned various aspects of the market, including revenue analysis, market share of key players, consumer trends, and regional comparisons. We also explored the factors driving market growth and the challenges that could impact future developments.

Our methodology involved collecting and analyzing data from multiple sources to ensure a robust and accurate representation of the market. We focused on delivering actionable insights that our client could use to enhance their market strategies and capitalize on emerging opportunities.

This case study presents the findings of our research in a structured and straightforward manner, making it easy to understand the complexities of the market. Through this report, we aim to provide a clear picture of the consumer electronics landscape and highlight the trends that will shape the future of this dynamic industry.

Our Approach

To understand the consumer electronics market better, we took a broad yet detailed approach, focusing on three main areas. First, we looked at the global consumer electronics market. We wanted to get a sense of the overall trends and developments happening around the world. This meant diving into things like what drives the market, how revenue is changing over time, and what new technologies are making waves. It was all about getting the big picture.

Then, we zoomed in on Europe to see how things are going with consumer electronics manufacturing there. We analyzed everything from revenue figures to how many businesses and jobs are growing in the industry. We also dug into who the major players are and what challenges and opportunities they’re facing. This helped us understand the manufacturing side of things and the unique dynamics at play in Europe.

Lastly, we turned our attention to the United States to explore the retail side of the market. This involved looking at revenue trends, employment figures, and how consumers behave when it comes to buying electronics. We wanted to see how retail channels are evolving, especially the differences between online and offline shopping, and what factors are influencing people’s purchasing decisions. By examining these aspects, we could see how the retail landscape is shifting and what that means for the market overall.

By taking this approach, we were able to gather a lot of valuable insights. It helped us understand the differences and similarities between regions and gave us a clear picture of the emerging trends that are shaping the future of the consumer electronics industry.

Global Market Overview

The global consumer electronics market has experienced remarkable growth over the past few years, driven by rapid technological advancements and increasing consumer demand. This section delves into the overall landscape of the market, exploring historical trends, current revenue figures, and the key factors that influence the industry.

Historical Market Trends and Revenue Analysis

When we look back at the market trends from 2018 to 2027, it’s evident that the consumer electronics sector has been on an upward trajectory. For instance, in 2018, the market was valued at approximately $0.98 trillion, according to Statista, while Deloitte estimated it at $0.81 trillion. This discrepancy between sources highlights the dynamic nature of market valuations, which can vary based on different analytical approaches.

As we moved into 2019, the market saw a slight increase to $1.02 trillion, and this growth continued in subsequent years. By 2021, the market had reached $1.11 trillion, showcasing the robust demand for consumer electronics globally. Projections for the future remain optimistic, with an expected market size of $1.20 trillion by 2027. This consistent growth underscores the market’s resilience and adaptability, even in the face of economic uncertainties.

Key Market Drivers

We’ve noticed that the growth in this market is driven by a few key factors. First, there’s a growing consumer demand fueled by health and wellness awareness. More people are becoming health-conscious, so they’re looking for electronics that can help monitor and improve their well-being. Devices like fitness trackers, smartwatches, and health monitoring systems are now staples in many homes.

Technological advancements are also a big part of this growth. Innovations in artificial intelligence, the Internet of Things (IoT), and 5G connectivity have made consumer electronics smarter and more appealing. These technologies enhance the user experience, making these devices highly desirable.

Shifting consumer preferences are another major influence. Today’s consumers are more tech-savvy and eager to get the latest gadgets that offer better performance and new features. With the trend toward digitalization, more people are working, learning, and entertaining themselves online, which increases the demand for advanced electronic devices.

Lastly, the rise in disposable income, especially in developing regions, plays a crucial role. As people have more money to spend, they’re more likely to buy new electronic gadgets, from smartphones and laptops to home entertainment systems. This boost in spending power is driving the demand for the latest consumer electronics.

Revenue Analysis

When we look at the consumer electronics market, we see that revenue comes from a variety of sources and product categories. Some of the main categories include computing devices, drones, gaming equipment, telephony, TV, radio, multimedia, and TV peripheral devices. Each of these categories contributes differently to the overall market revenue.

For instance, computing devices have been a significant revenue driver. Back in 2018, they brought in around $286.9 billion. This number steadily grew, reaching $332 billion by 2021. Although there was a slight dip in 2022 to $312.7 billion, the market is expected to bounce back, with projections suggesting it could reach $348.5 billion by 2028.

Drones, while a smaller segment, are growing steadily. Starting at $2.9 billion in 2018, the revenue is expected to rise to $4.7 billion by 2028. Gaming equipment has seen impressive growth as well, doubling from $18.1 billion in 2018 to a projected $37.7 billion by 2028.

Telephony is another major revenue contributor. It saw a rise from $446.1 billion in 2018 to $500.3 billion in 2021. Despite some fluctuations, it is projected to reach $560.1 billion by 2028. TV, radio, and multimedia also show steady growth, from $178.7 billion in 2018 to a projected $209.9 billion by 2028. TV peripheral devices, though smaller, are on an upward trend, growing from $7.7 billion in 2018 to an estimated $15.9 billion by 2028.

Overall, the total market revenue has been growing, starting at $940.4 billion in 2018, and is expected to reach $1,177 billion by 2028.

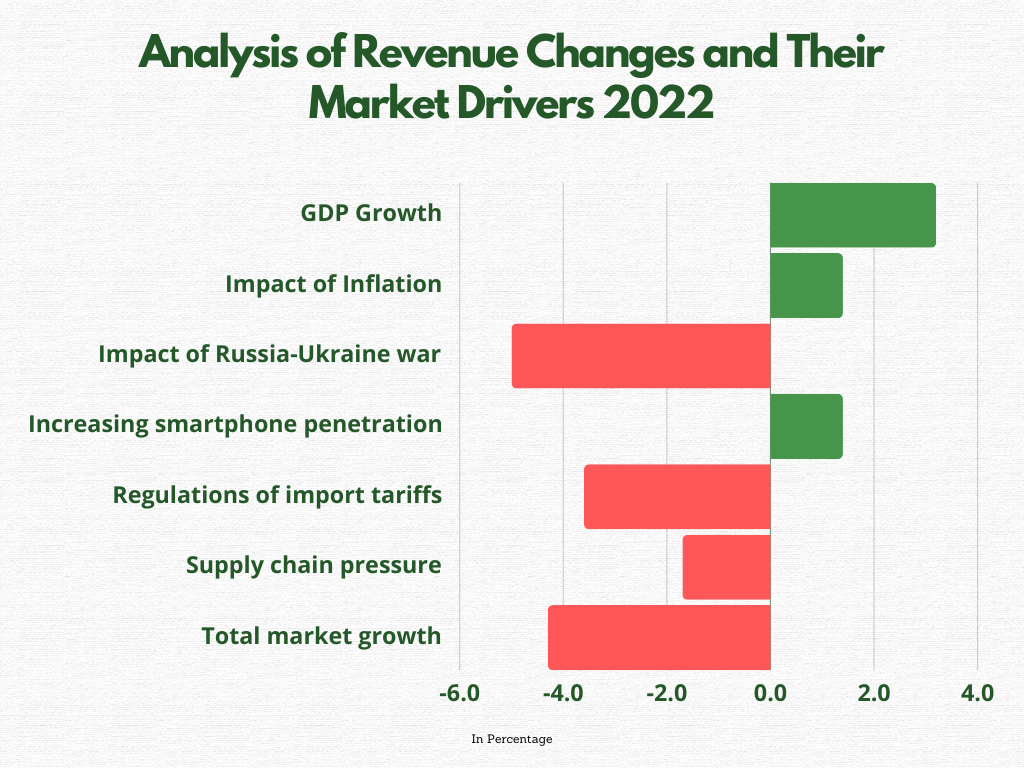

Analysis of Revenue Changes and Their Market Drivers

When we look at the global consumer electronics market from 2018 to 2027, we observe several critical factors that have influenced revenue changes. These factors vary from economic indicators like GDP growth to specific industry pressures such as supply chain constraints.

Firstly, GDP growth has played a significant role in shaping market dynamics. In 2022, the global GDP growth rate stood at 3.2%. This growth provided a positive boost to consumer spending power, allowing for increased expenditure on electronic goods. As economies expand, consumers typically have more disposable income, which they often channel into purchasing the latest gadgets and electronics.

On the flip side, inflation has had a noticeable impact on market revenues. With a 1.4% contribution to revenue changes, inflation has driven up the costs of production and logistics. This rise in costs often translates into higher prices for consumer electronics, which can dampen demand as consumers may defer purchases in response to rising prices.

A significant negative influence has been the Russia-Ukraine war, which has led to a 5% decrease in market growth. The conflict has disrupted supply chains, increased geopolitical tensions, and caused economic instability in many regions, all of which have negatively impacted the global consumer electronics market. This war-induced disruption has been one of the most substantial adverse factors affecting the industry.

On a more positive note, the increasing penetration of smartphones contributed positively to revenue changes of 1.4%. As smartphones become more ubiquitous, the demand for related consumer electronics, such as accessories, smart home devices, and wearable technology, also rises. This trend signifies a shift towards a more interconnected and smart living environment, driving growth in various sub-segments of the consumer electronics market.

Regulations on import tariffs have also posed challenges, contributing to a 3.6% reduction in market growth. These regulations have increased the cost of imported goods, making consumer electronics more expensive in various markets. This cost increase can lead to reduced consumer demand and lower sales volumes, impacting overall market revenue.

Supply chain pressure has been another critical factor, causing a 1.7% decrease in market growth. The global supply chain has faced numerous disruptions, from shipping delays to component shortages. These pressures have not only increased costs but also resulted in longer lead times for product availability, affecting sales and revenue.

In summary, the combined effects of these drivers led to an overall market growth reduction of 4.3% in 2022. Understanding these factors provides a clearer picture of the complexities within the global consumer electronics market and highlights the importance of strategic planning and adaptability for businesses operating in this sector. This detailed revenue analysis helps us understand the financial landscape of the consumer electronics market. These insights enable our client to strategically position themselves to capitalize on emerging opportunities and stay ahead in this dynamic industry.

Regional Insights

Understanding the consumer electronics market requires a deep dive into specific regions to grasp the unique dynamics and trends that drive growth and influence industry performance. In this section, we explore two critical regions: Europe, focusing on consumer electronics manufacturing, and the United States, examining consumer electronics stores. This will help paint a comprehensive picture of the industry from a regional perspective.

Consumer Electronics Manufacturing in Europe

In Europe, the consumer electronics manufacturing sector is a substantial contributor to the economy, with revenue of €24 billion in 2024, despite a slight decline of 3.0% from previous years. This industry encompasses 3,862 businesses, reflecting a healthy growth rate of 3.2%. Employment in this sector also shows positive trends, with 83,974 people employed, marking a 2.3% increase. However, wages have seen a minor decline of 2.0%, totaling €2.4 billion.

Profit Margins

So, here’s what we found out about the industry’s profits! Over the years from 2019 to 2024, the industry brought in a total profit of €1.4 billion, with profit margins sitting at a decent 5.7%. However, there was a slight decrease in profit margins during this period, dropping by 0.9%.

Taking a step back and looking at the bigger picture from 2011 to 2024, we spotted some interesting trends. Profit margins hit their highest point at 6.7% back in 2012 but had lows at 5.4% in a few years like 2014, 2018, and 2023.

Looking ahead, for 2024, the projected profit margin remains steady at 5.7%. This indicates a consistent path forward, especially when we consider the historical ups and downs we’ve seen in the numbers.

Revenue Trends

Revenue trends for the European consumer electronics manufacturing industry show a varied picture. From 2011 to 2029, revenue experienced several ups and downs. For example, in 2012, the revenue decreased significantly by 7.1%, followed by a 13% drop in 2013. Despite these setbacks, there were periods of recovery, like the 8.6% increase recorded in 2021.

As we look towards the future, the industry is anticipated to witness moderate growth. Projections indicate that revenues are poised to reach €28.6 billion by 2029. This outlook suggests a positive compound annual growth rate (CAGR) of 0.1% from 2019 to 2024. These figures highlight the industry’s resilience and adaptability, showcasing both challenges faced and opportunities for growth in the consumer electronics sector in Europe.

Revenue Growth by Country

When we look at the revenue growth across different European countries, we see quite a range. Ireland, for example, leads with an impressive growth rate of 87.0%. Lithuania follows this at 51.2% and Switzerland at 24.2%. On the flip side, some countries face more challenges. Turkey, for instance, has experienced a decline of 16.5%, Estonia by 15.5%, and Croatia by 14.0%. This variation highlights the different economic conditions and market potentials across Europe.

Major Players and Market Shares

The European consumer electronics manufacturing market is dominated by several key players. The Samsung Group is a standout, holding a market share of 6.8%, with revenue reaching €218 billion and a profit margin of 6.2%. LG Electronics follows with a 3.2% market share, earning €64.27 billion in revenue and a 4.1% profit margin. Other notable companies include Koc Holding AS, Panasonic Holdings Corporation, and Robert Bosch GmbH. Each of these players holds significant market shares and contributes to the competitive landscape.

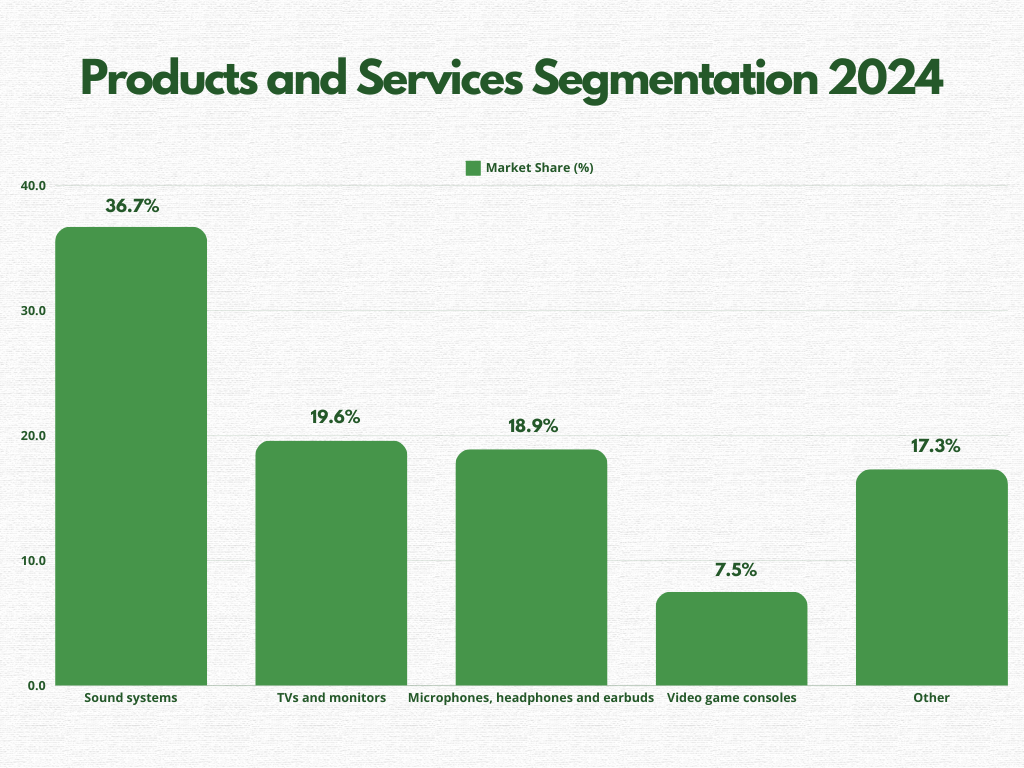

Products and Services Segmentation

The product offerings in this industry are diverse. Sound systems are the most significant segment, making up 36.7% of the industry’s revenue. TVs and monitors make up 19.6%, while microphones, headphones, and earbuds contribute 18.9%. Video game consoles and other electronics also play vital roles, representing 7.5% and 17.3% of the market, respectively. This segmentation showcases the varied consumer preferences and technological advancements driving the industry.

Consumer Electronics Stores in the US

So, we delved into the consumer electronics retail market in the United States, and it’s quite a powerhouse within the electronics industry. From 2019 to 2024, the industry generated substantial revenue of $168.5 billion, though it experienced a slight decline at a growth rate of -1.0%. This negative growth reflects some of the economic challenges and market saturation the industry faced during this period. Looking ahead, the forecast for 2024–2029 is more optimistic, with a projected growth rate of 0.5%, indicating a slow but steady recovery.

The employment landscape within the sector has been more concerning. From 2019 to 2024, the number of employees dropped by 6.3%, down to 371,000. This trend is expected to continue, however, at a slower rate of -0.6% from 2024 to 2029. This decline in employment could be attributed to increased automation, shifts to online retailing, and an overall market contraction.

Similarly, the number of businesses operating within this sector also saw a reduction. From 2019 to 2024, the number of businesses decreased by 2.8%, and this trend is projected to continue with a further decline of 0.9% from 2024 to 2029. Despite these challenges, the total profit for the industry grew slightly by 0.5% from 2019 to 2024, reaching $7.1 billion with a profit margin of 4.2%.

Profit Margin

So, if we take a closer look at the profit margins from 2011 to 2024, we can see that there were quite a few ups and downs. Back in 2011, the profit margin was 3.5%. It then nudged up a bit to 3.7% in 2012 and saw a nice jump to 4.6% in 2013.

However, there was a noticeable drop in 2014 to 4.1%, which continued on a downward trend to 4.0% in 2015. As we moved ahead, the profit margin didn’t really swing wildly but showed some small shifts, finally settling at 4.2% in 2024. This suggests that, despite facing challenges in the market, things eventually found some stability.

Revenue Trends

When we turn our focus to the revenue trends from 2019 to 2029, we get a clear picture of the market’s ups and downs. Back in 2011, the industry was doing pretty well, hitting a revenue peak of $173.9 billion. The following year, it inched up a bit more to $177.4 billion. However, things didn’t stay good. In the years that followed, we saw some declines, with a notable dip to $170.5 billion in 2016.

The most dramatic drop happened in 2020, when revenue plunged to $136.9 billion, primarily due to the COVID-19 pandemic’s impact. But the industry proved resilient, bouncing back impressively to $166.5 billion in 2021. Looking ahead, the projections are cautiously optimistic. By 2029, we expect the revenue to climb to around $172.4 billion. These insights were gathered through a thorough analysis of historical sales data, economic indicators, and market forecasts.

Product Segmentation

In 2024, when we took a closer look at the revenue streams for consumer electronics stores in the US, we found that the market is divided into several key product lines. Computer hardware and software really lead the pack, making up 47.7% of the industry’s revenue. This makes a lot of sense given the strong demand for laptops, desktops, and related software, which has been driven by the shift to remote work and the rapid pace of technological advancements.

TVs and audiovisual equipment come in next, accounting for 25.6% of the revenue. This reflects the ongoing consumer interest in home entertainment systems, especially as more people are investing in high-quality setups for their living rooms. Appliances also make a significant contribution, representing 19.4% of the revenue. This category includes a broad range of household electronics, from refrigerators to washing machines, which are essential in every home.

Even though services form a smaller segment, they still account for 2.6% of the revenue. This includes everything from repairs and installations to other customer support services, which are crucial for maintaining customer satisfaction and loyalty. The remaining 4.7% covers various other electronics and accessories, adding to the diversity of products available on the market.

We gathered this detailed segmentation from a mix of sales reports, consumer behavior studies, and market analysis tools. This comprehensive approach allowed us to get a clear picture of how different product categories contribute to the overall revenue of consumer electronics stores in the US.

Major Players and Market Shares

When we look at the competitive landscape in the US market, we see that a few key players dominate the scene. Best Buy Co., Inc. is at the forefront, holding an impressive 18.5% market share. In 2024, Best Buy generated $31,208.90 million in revenue and made a profit of $1,618.40 million, which gives them a profit margin of 5.2%. Best Buy’s success can be attributed to its strong market presence and a wide range of products that appeal to many consumers.

On the other hand, Gamestop Corp. has a much smaller market share of 1.8%. In 2024, they earned $2,994.30 million in revenue. However, Gamestop faced some significant challenges. They ended up with a negative profit margin of -4.4%, highlighting their financial struggles in such a competitive market. This contrast between Best Buy and Gamestop shows how different strategies and market positions can lead to vastly different outcomes in the same industry.

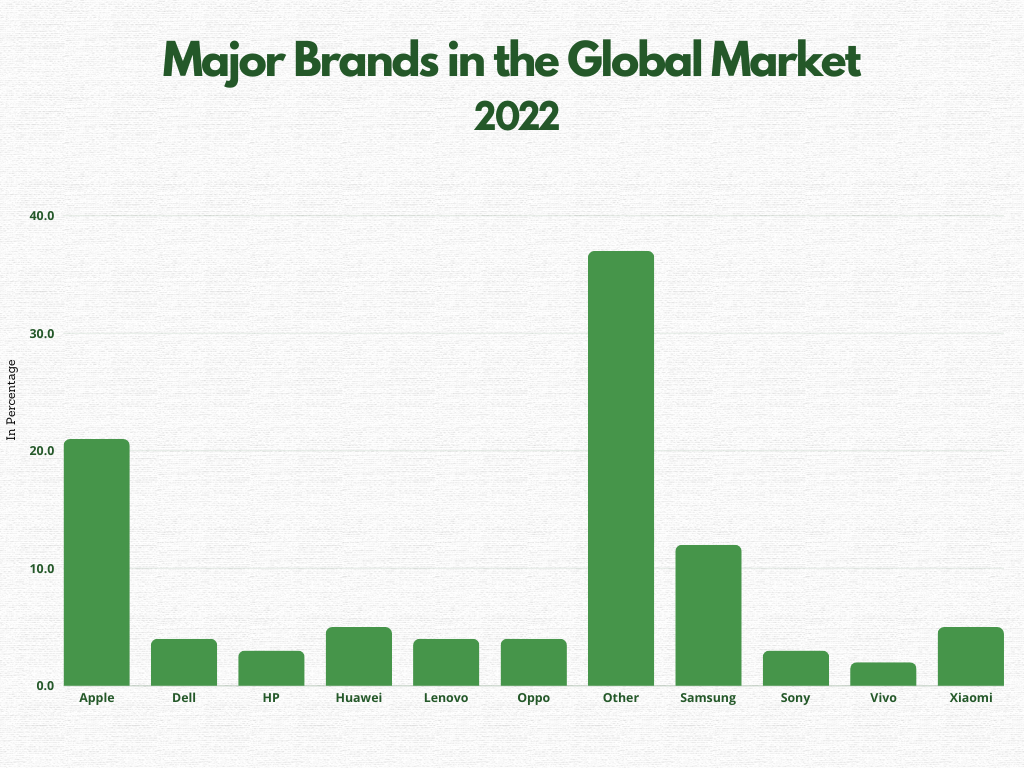

Global Market Shares and Key Players

When we dive into the global consumer electronics market, it becomes clear that a few major players dominate the scene. These companies not only lead in terms of innovation and market presence but also capture significant portions of the market.

Major Brands in the Global Market

In 2022, the global consumer electronics market was dominated by several leading brands. At the forefront is Apple, which holds a substantial 21% of the market share. Apple’s success can be attributed to its strong brand loyalty and a continuous stream of innovative products, from iPhones to MacBooks.

Following Apple, we have Samsung, which captures 12% of the market. Known for its wide range of products, including smartphones, televisions, and home appliances, Samsung has established a solid global presence.

As per the report, Huawei and Xiaomi each hold 5% of the market. Despite facing various challenges, including trade restrictions, Huawei has maintained its position through its robust product lineup and strong market presence in Asia. Xiaomi, known for offering high-quality electronics at competitive prices, has also secured a significant share.

Next, we have brands like Dell, Lenovo, and Oppo, each with a 4% market share. These companies have carved out their niches, with Dell and Lenovo being strong in the PC and laptop segments and Oppo making significant strides in the smartphone market.

HP and Sony each capture 3% of the market. HP remains a key player in the computing and printing segments, while Sony continues to be influential in the entertainment and gaming sectors.

Vivo holds a smaller share at 2%, focusing primarily on smartphones and making notable inroads in emerging markets.

The 'Other' Category

Interestingly, the ‘Other’ category, which includes numerous smaller brands, constitutes a large portion of the market at 37%. This diversity reflects the highly competitive nature of the consumer electronics market, where numerous players are continually innovating and vying for consumer attention.

Consumer Behavior and Trends

Understanding how consumers behave and what trends are shaping their preferences is crucial for anyone looking to succeed in the consumer electronics market. For our client, gaining insights into consumer spending patterns and emerging trends is not just beneficial but essential. Knowing where and how people are spending their money on electronics helps in making informed decisions about product development, marketing strategies, and investment opportunities. In this section, we’ll break down how people are spending their money on various types of electronics and identify key trends that are emerging in the market, providing a clear picture of what drives consumer choices.

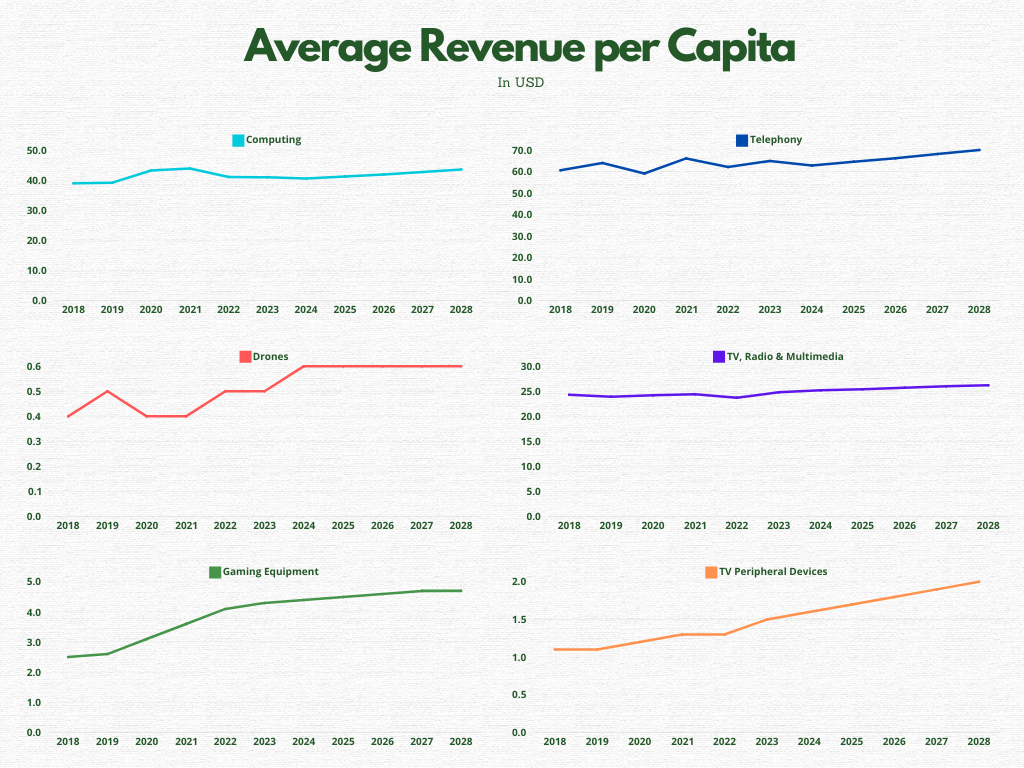

Average Revenue per Capita

When we want to understand how people are spending on consumer electronics, looking at the average revenue per capita is super insightful. It tells us how much, on average, each person is spending on various electronic categories. Here’s a look at the trends from 2018 to 2028:

Computing: People are spending more on laptops and desktops. Back in 2018, the average spend was about $38.97 per person. By 2020, it went up to $43.18 and is expected to hit $43.56 by 2028. This makes sense with everyone working from home and doing online classes.

Drones: Even though it’s a niche market, spending on drones is creeping up. It was $0.40 per person in 2018 and might reach $0.58 by 2028. It looks like more people are getting into drones for fun and for things like photography and agriculture.

Gaming Equipment: This category is really booming. In 2018, spending was $2.45 per person. By 2021, it had jumped to $3.63 and could be $4.71 by 2028. Gaming, including console and PC games, plus eSports, is getting super popular.

Telephony: Spending on things like smartphones has seen some ups and downs. It started at $60.59 per person in 2018, peaked at $66.13 in 2021, and might go up to $70.03 by 2028. This is probably because new smartphone models keep coming out, and people want to upgrade.

TV, Radio, and Multimedia: Spending here has been pretty steady, with slight increases from $24.28 in 2018 to an expected $26.24 by 2028. Traditional media devices still have a solid place in our lives, despite all the new technology.

TV Peripheral Devices: Spending on stuff like streaming gadgets and sound systems is on the rise, from $1.05 per person in 2018 to a projected $1.99 by 2028. More people are getting into smart TVs and home entertainment systems.

Total Average Revenue per Capita: When we add everything up, the total average spending per person was $127.7 in 2018 and could go up to $147.1 by 2028. Overall, it looks like we’re all spending more on electronics as they become more integrated into our daily lives.

Emerging Trends in the Market

To gain a comprehensive understanding of the consumer electronics market, it’s essential to identify the emerging trends within the industry. To achieve this, we have consulted numerous sources and explored various regions. This research reveals several key trends that are currently influencing consumer behavior in the consumer electronics market:

Technology Integration

We noticed a growing desire among consumers for devices that integrate seamlessly with other technologies in their lives. It became evident as we looked at the popularity of smart home devices that work harmoniously with smartphones and computers. Imagine having a single ecosystem where your phone, laptop, and home automation systems all communicate effortlessly. This trend underscores the increasing consumer expectation for interconnected, user-friendly tech solutions. It’s a trend driven by convenience and the quest for a more streamlined lifestyle.

Sustainability

One of the most striking findings was the heightened demand for eco-friendly electronics. Consumers today are more environmentally conscious than ever before. Our research highlighted that people prefer products made from recycled materials or those with a smaller environmental footprint. This shift is crucial because it signals a change in purchase drivers—it’s not just about having the latest gadget but also about making responsible choices. Companies that align with this eco-conscious mindset are likely to gain a competitive edge.

Customization and Personalization

We also discovered that personalization is a significant trend, especially in the gaming and computing sectors. Consumers want their devices to be extensions of their identities. Whether it’s customizing the look of their gaming setups or tailoring software functionalities to better meet their needs, personalization options are becoming highly valued. This trend is driven by the desire for uniqueness and individuality, where one-size-fits-all no longer satisfies tech-savvy consumers.

Health and Wellness

Another fascinating trend is the rise of health and wellness electronics. Devices like fitness trackers and smart health monitors are gaining popularity as more people adopt a health-conscious lifestyle. Our research showed that consumers are not just looking for functionality but for devices that offer insights into their health. This trend is particularly significant as it reflects a broader societal shift towards prioritizing health and wellness in everyday life.

Volume and Pricing Analysis

In this section, we will examine the volume of consumer electronics sold and the pricing trends over time. These aspects are critical, as they directly impact market dynamics and consumer behavior.

Volume Analysis

When we discuss volume in the consumer electronics market, we refer to the number of units sold across various categories such as computing devices, drones, gaming equipment, telephony, and multimedia devices. Analyzing these trends from 2019 to 2028 provides valuable insights into market behavior.

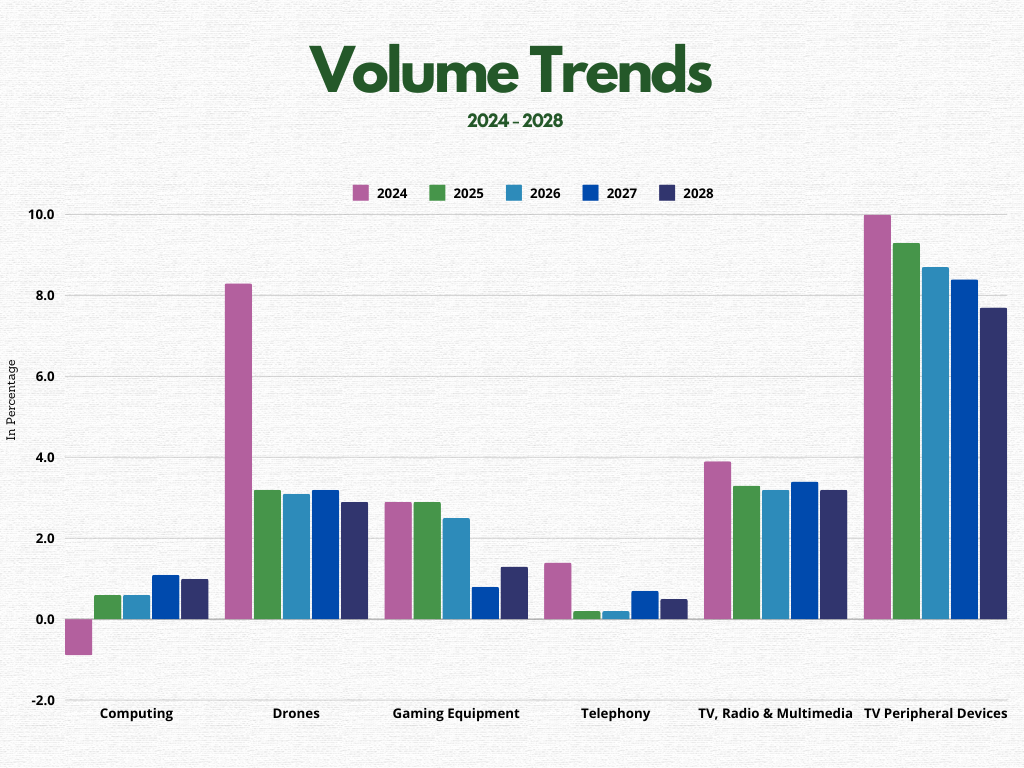

Volume Trends

Computing: The computing segment saw a significant surge in 2020, with a 10.5% increase, largely due to the pandemic-induced shift to remote work and learning. However, a decline of 9.2% was observed in 2022. The segment stabilizes from 2023 onwards with minor fluctuations, averaging around 0.5% to 1.1% annual growth.

Drones: The drone market has exhibited volatility. After a 9.1% decline in 2020, it rebounded strongly with a 25.7% increase in 2022. Subsequent years show positive growth, averaging around 3.1% to 3.2% towards the decade’s end.

Gaming Equipment: This sector experienced remarkable growth in 2020 and 2021, with increases of 22.9% and 11.3%, respectively. Although growth rates taper off in later years, they remain positive, reflecting sustained consumer interest in gaming products.

Telephony: The telephony segment showed moderate fluctuations, with a 9% decline in 2020 followed by a 5.3% growth in 2021. Growth rates stabilize between 0.2% and 0.7% in subsequent years.

TV, Radio, and Multimedia: This category demonstrated steady growth, including an 11.6% increase in 2020. Despite a 6.3% dip in 2022, the category recovers, maintaining growth rates between 3.2% and 5.8% annually.

TV Peripheral Devices: Peripheral devices saw consistent growth, peaking at 16.1% in 2020. Although growth rates gradually decline, they remain robust, ranging from 7.7% to 11.8% over the years.

Total Volume: The overall volume of consumer electronics increased by 5.9% in 2020, followed by a decline of 5.6% in 2022. The market stabilizes with modest growth rates, averaging around 1.3% to 1.9% annually.

Pricing Trends

Understanding pricing trends in the consumer electronics market is crucial for several reasons. First, it helps consumers make informed purchasing decisions, ensuring they get the best value for their money. Second, it allows companies to strategically position their products in a competitive market. By analyzing pricing trends, we can identify patterns that reveal how innovation, competition, and consumer demand shape the market. This knowledge is essential for predicting future price movements and making sound business decisions.

General Trend

Over the years, we’ve noticed that the average price of many electronic devices has stayed relatively stable. While there are some ups and downs, these changes tend to be small, keeping the overall market accessible to a wide range of consumers.

Premium vs. Budget Products

One of the key trends we found is the clear difference between premium and budget products. On the premium side, high-end devices, like the latest flagship smartphones and top-tier laptops, often see price increases. These premium products are packed with the newest features and cutting-edge technology, which explains their higher prices. Consumers who buy these devices expect top-notch performance, advanced capabilities, and the prestige of owning the latest and greatest model.

On the flip side, we’ve seen a trend towards more affordable products. Entry-level smartphones, basic laptops, and budget-friendly gadgets have become cheaper over time. This is mainly because of advancements in manufacturing processes, increased competition among brands, and economies of scale. As a result, even those with limited budgets can access and enjoy modern technology.

Global Comparison

When we look at the consumer electronics market globally, in Europe, and in the US, we can see some clear differences and similarities. The global market has been growing steadily, driven by technological advancements, rising disposable incomes, and increasing consumer demand for advanced electronic devices. By 2027, the global market is expected to reach a whopping $1.20 trillion, showcasing its resilience and adaptability even amid economic uncertainties.

In Europe, the focus is heavily on manufacturing, which contributes significantly to the region’s economy. Despite a slight decline in revenue growth, the European market shows positive trends in business growth and employment. For instance, the revenue from consumer electronics manufacturing was €24 billion in 2024, with a growth rate of 3.2% in business units and 2.3% in employment. However, challenges like fluctuating profit margins and economic conditions highlight the region’s vulnerabilities.

On the other hand, the US market, particularly in consumer electronics retail, has faced some ups and downs. The industry generated substantial revenue, reaching $168.5 billion from 2019 to 2024, despite experiencing a slight decline. Employment trends in the US show a decrease, influenced by automation and shifts toward online retailing. Best Buy dominates the market with an 18.5% share, while other players like Gamestop struggle with negative profit margins. The US market’s ability to bounce back from challenges like the COVID-19 pandemic and its ongoing adaptation to new retail trends reflect its resilience.

Overall, while the global market shows consistent growth and robust demand, Europe’s strength lies in its manufacturing capabilities, and the US market is characterized by its competitive retail landscape and adaptability to changing consumer behaviors. These regional insights highlight the diverse dynamics at play in the consumer electronics industry, offering valuable lessons and strategies for stakeholders across different markets.

Conclusion and Recommendations

As we wrap up our exploration of the global consumer electronics market, it’s clear that this industry is both dynamic and resilient. Despite facing economic challenges, the market continues to grow, driven by technological advancements and increasing consumer demand. The projections are optimistic, with the market expected to reach $1.20 trillion by 2027.

Technology plays a huge role in this growth. Innovations in areas like AI, IoT, and 5G are making devices smarter and more integrated into our daily lives, enhancing their appeal. Consumers are eager for the latest gadgets that offer better performance and new features, driving the demand for advanced electronics.

Regionally, Europe and the US present unique insights. In Europe, the manufacturing sector is a major economic contributor, despite some challenges like fluctuating profit margins. The US retail sector, meanwhile, shows a competitive and evolving landscape, with companies like Best Buy leading the way. The shift towards online shopping and increased automation are reshaping how electronics are sold and purchased.

Consumer behavior is also shifting, with a growing preference for devices that integrate seamlessly with other technologies. There’s a notable trend towards sustainability, with more consumers seeking eco-friendly products. Personalization is becoming increasingly important as people want their devices to reflect their personal style and needs. Health and wellness electronics are also on the rise as more individuals look to technology to help monitor and improve their health.

Revenue trends across different product categories reveal a stable market with distinct segments. High-end devices continue to see price increases due to their advanced features, while budget products become more affordable due to improved manufacturing processes and increased competition.

Globally, the market shows consistent growth, with each region having its own strengths and challenges. Europe excels in manufacturing, while the US leads in retail innovation. This diversity highlights the importance of adapting strategies to fit regional dynamics.

In summary, the consumer electronics market is full of opportunities. By staying ahead of technological trends, embracing sustainability, and understanding regional differences, companies can thrive in this ever-evolving industry.

Tell us

About your project!

Request for a proposal